Saving money during challenging economic times is not only a prudent financial practice but also a crucial step towards maintaining stability and security.

When faced with economic uncertainties such as recessions, market volatility, or job insecurity, building up savings becomes even more vital.

It serves as a safety net to cover unexpected expenses, mitigate financial hardships, and provide a sense of financial resilience.

In this guide, we will explore effective strategies and practical tips to help you save money during challenging economic times.

By implementing these strategies and adopting a proactive mindset towards your finances, you can navigate difficult periods with greater confidence and emerge stronger on the other side.

Let's dive in and discover the art of saving money in uncertain times.

1. Assess Your Current Financial Situation: Start by evaluating your income, expenses, and overall financial picture. Take note of your essential expenses and identify areas where you can potentially reduce discretionary spending.

Understanding your financial standing will provide a foundation for developing a saving plan.

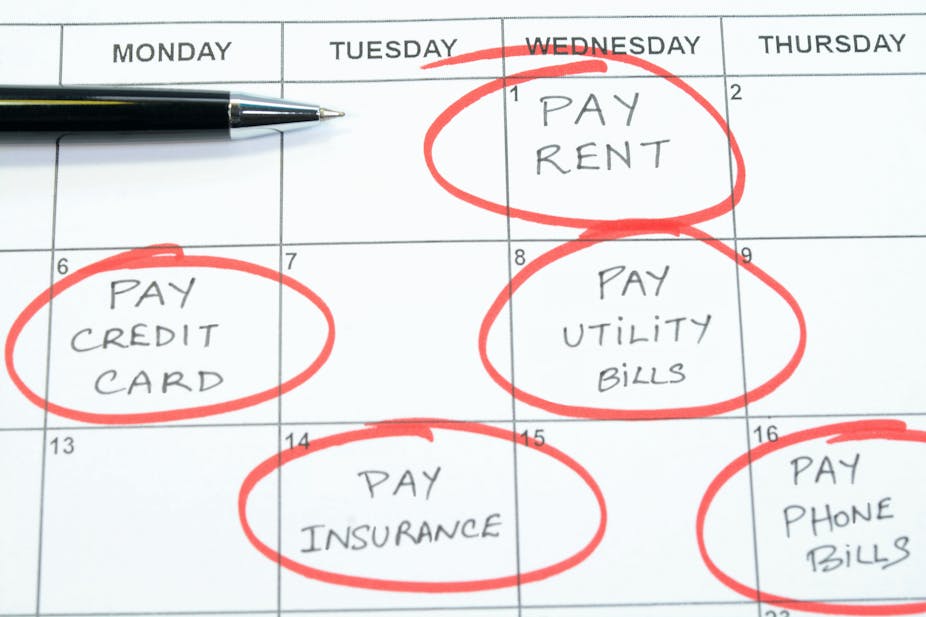

2. Create a Budget: Develop a comprehensive budget that outlines your income, expenses, and savings goals. Prioritise essential expenses such as housing, utilities, and groceries while finding areas to cut back on non-essential spending.

Track your expenses regularly to ensure you stay within your budget.

3. Cut Back on Discretionary Spending: Identify areas where you can reduce unnecessary expenses. This might include dining out less frequently, cutting back on entertainment expenses, or finding cheaper alternatives for certain goods or services.

Look for creative ways to save money without sacrificing too much quality of life.

4. Review and Negotiate Bills: Review your recurring bills such as utilities, cable, internet, and insurance. Research competitive rates, and consider negotiating with service providers to secure better deals or discounts. You'd be surprised how much you can save by simply asking.

5. Build an Emergency Fund: In challenging economic times, having an emergency fund is crucial. Aim to set aside three to six months' worth of living expenses in a separate savings account.

Start small if needed, but make it a priority to consistently contribute to your emergency fund until it reaches an adequate level.

6. Automate Your Savings: Set up automatic transfers from your checking account to your savings account. By automating your savings, you remove the temptation to spend the money and ensure consistent contributions towards your financial goals.

7. Reduce Debt and Interest Payments: Prioritise paying off high-interest debt to save money on interest payments. Consider consolidating debt or negotiating lower interest rates with lenders.

Make extra payments whenever possible to accelerate the debt payoff process.

8. Explore Ways to Increase Income: In challenging economic times, it may be necessary to find additional sources of income. Consider taking up part-time work, freelancing, or starting a side business.

Generating extra income can help boost your savings and provide a cushion during financial difficulties.

9. Review and Optimise Insurance Coverage: Assess your insurance policies to ensure you have adequate coverage at the most competitive rates. Shop around for insurance quotes and consider bundling policies to save on premiums.

10. Stay Informed and Adapt: Stay updated on economic trends, policy changes, and market conditions. Being informed can help you make proactive decisions and adjust your financial strategies accordingly.

Be open to adapting your saving plan as circumstances evolve.

Saving money during challenging economic times requires discipline, careful planning, and a proactive approach to your finances. By assessing your financial situation, creating a budget, reducing expenses, building an emergency fund, and exploring ways to increase income, you can strengthen your financial position and weather economic uncertainties with greater confidence.

Remember that saving money is a long-term commitment, and small, consistent steps can lead to significant financial stability over time.